Laura Martin, Needham, introduces George Barrios. She notes they still have a $25 buy rating on WWE.

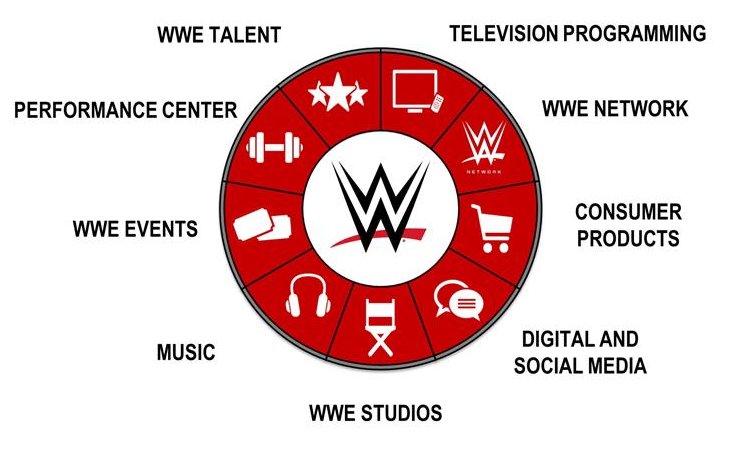

George Barrios gives his normal investment pitch to start the presentation.

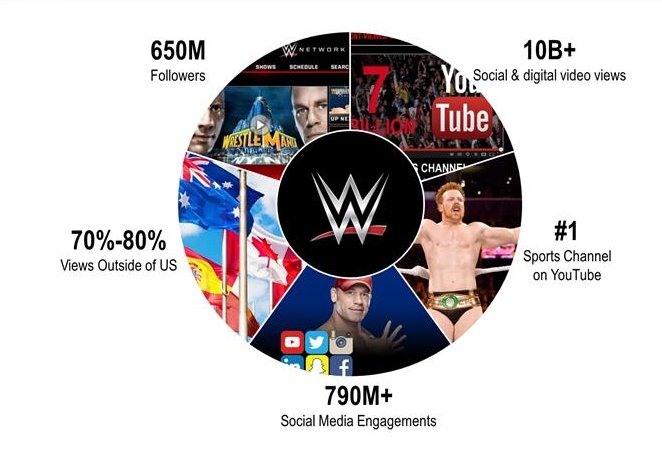

The 70-80% views outside the US is important.

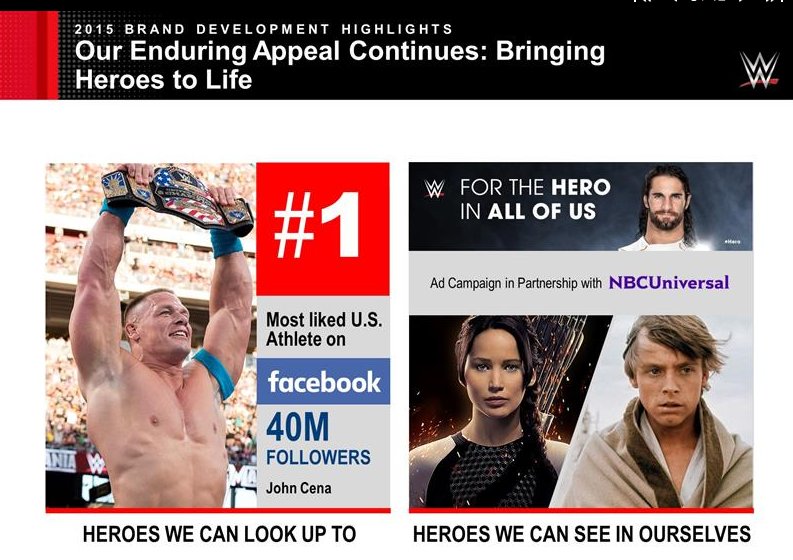

Barrios uses the Joseph Campbell "Hero's Journey" as the analogy for what WWE does.

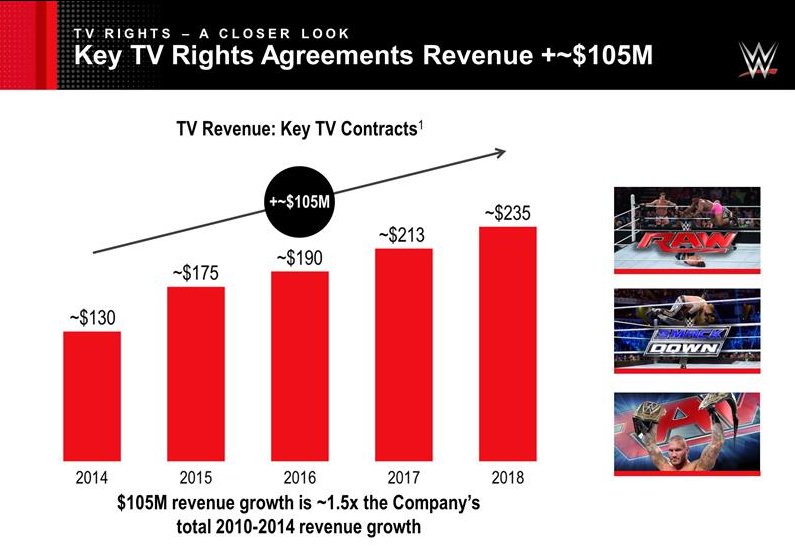

WWE has their major TV rights agreements tied up through 2018. However, this does include the CTH/Thailand estimates which ended up with that international distributor defaulting on their contract for non-payment. This has never been addressed publicly by WWE.

Barrios notes they have "up to about 5,100 hours of WWE Network content and 150,000 hours in their library"

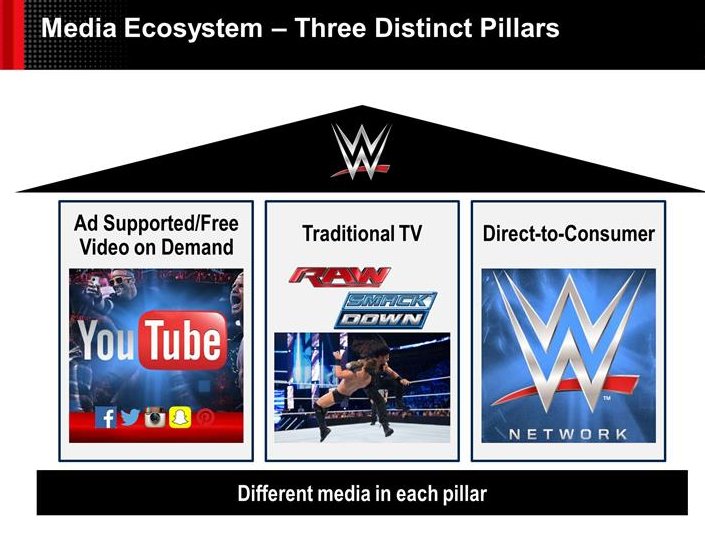

Laura Martin asks: "If YouTube is only $10M annually, why do I care?"

George Barrios' answer:

Three layers: First, the ability to engage 24/7 (we measure by time). When you're an entertainment property that means your ultimate measure is time. Our ability to drive that number continually higher is hugely important to us. That means more action figures and more subscriptions and more viewership in Pay TV (which manifests itself in the renewal pay cycle). Second, Kid's TV time is all about YouTube & NetFlix - that's where they spend their time. Multi-generational viewing continues in front of the TV but more & more of our next generational fans will come from these platforms. Lastly, if you look over the last hundred years of media, the money has followed the eyeballs. But it takes time. It takes the money longer than the behavior. The behavior changes and the money at first stays where the old behavior was, and then there's a tipping point. Eventually that becomes a big money maker.Martin: "I can't directly generate money from it. But it lowers the cost of customer acquisition. But the social chatter lowers cost of acquiring a new WWE Network subscriber or a new television viewer... It broadens the funnel at the top and hopefully it trickles down."

Barrios: "Not hopefully! By our math, it happens."

George Barrios is quoting the David Carr article, "The Stream Finally Cracks the Dam of Cable TV" about the "scary place" which is the "long, dark hallway" when you're embarking of these sort of investments which involve changes in how media is distributed and consumed.

Barrios notes that they were six-months in and were "still trying to escape gravity".

Barrios talks about decision to partner instead of go-it-alone when WWE was launching the WWE Network.

Martin: What did you do wrong?

Barrios: Biggest regret - we didn't do it earlier.

Martin: Doesn't count.

Barrios OTT regret: When we launched - we had a 6-month commitment pricing - no promotional element - no free trial. #wweneedham

Laura Martin asked re: value proposition of the WWE Network pointing out the original conceit was to have WM separate/premium. #wweneedham

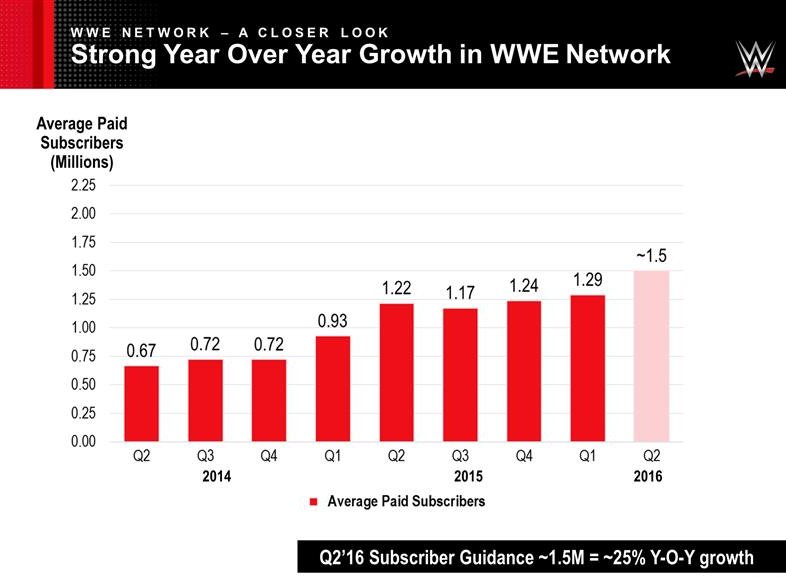

Barrios: "Our analog was the 12 PPVs annually provided through the MVPD community. The whole conceit of the Network in 2011 was thinking about that flat PPV business, monetizing our large & growing archive, and the best place to create new content. At $60 you have x amount of people 900,000-1,000,000 homes that bought 3-4 PPVs each year. At $9.99 with all this content, not just the three hours, we believed we could get beyond that 900,000 to 1,000,000. Now we're at 1.5 million which is up 25% year-over-year- we turned $80 million business into $160 million business - doubled. You have to believe lower price point, more content - penetrate more users."

Barrios talks about BB homes and goal to 3-4 million subscribers.

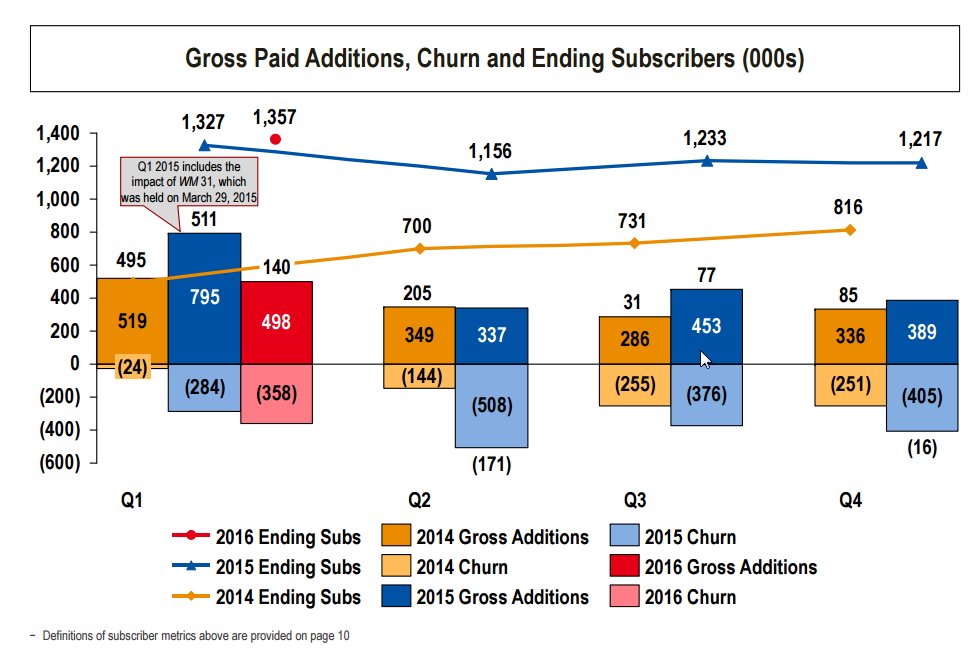

"Anyone work in a subscription business? You work in one,there's churn.Subscription businesses are like retail."

"Two years ago there was 2 people who worked in a subscription business. I was one of them."

"There will always be churn but we always want it to be lower than it is now."

Martin: "the 3M-4M sub projection - how does the looks sub mix in maturity?"

Barrios: "Prelaunch est was 25%-30% come from outside US. 15 years from now, it might be different."

Martin: How are you using Data from OTT to change programming & advertising?

Barrios:

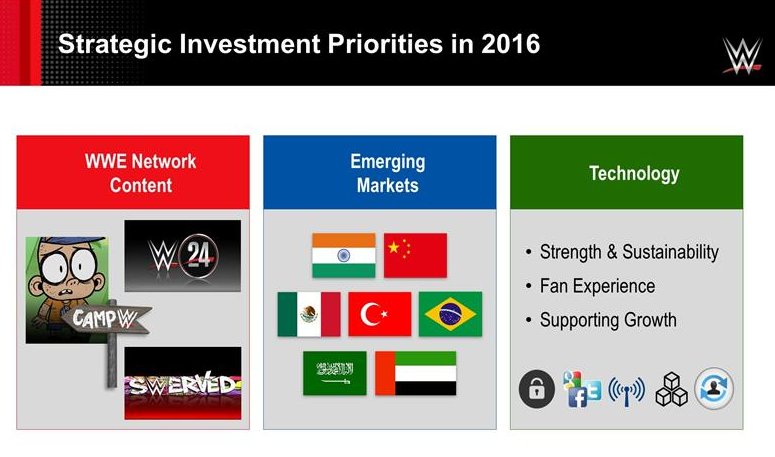

5-6% of revenue in 2010 came from a digital source. Now it's 30% in 2015 primarily because of the WWE Network but we've had growth across all our digital businesses. Amount of data that we collect has quintupled in last 24 months because of WWE Network. We've always invested in technology but we're probably investing 3-4x vs what we used to.

The data helps us within each business. I'm able to run WWE Network more effectively because of the data in a variety of ways. I can see what people are looking at or watching. What are people watching? What shows? Where to spend money on programming the next time around?). It's not a survey or sampling like Nielsen. We get real data.

It helps us on the marketing. When you have the data, you can have customer profiles based on the data.

Netflix says they have 72,000 customer segments. That's 1,000-2,000 people in each segment. We started with one. We have more now. (Martin: Dozens?) It's there and climbing fast.

We don't care if it's a 12-year old boy and a 45-year old woman watching the same show - that's now a segment.

Even predicting churn which helps you stop it. Our predictive model has 25 different models based on which country they come from, are they a win-back, viewing habits and time of acquisition. My guess is a year from now it'll be 50 datapoints.

Similar stories on data on our e-commerce is how you sell more t-shirts. The real magic on the data side is how to integrate all of these data sets with the holy grail being social.Audience Q&A

All these social platforms have different data structures. The ability to link our FB data to my YouTube data to our ticketing data to e-commerce data to Network dat ais a long slog for us. But that's what we're working on. We think that's what's super powerful. That's WWE 360 2.0.

Audience: Why did subs go fly last year given enormous growth of content and spending on the Network?

Barrios: We've seen a cyclicality to the Network around WrestleMania. We have a big event. WM is the biggest "funnel-filler" to the Network. The math around that means we'll see year-over-year growth but may see a sequential decline. Right now to continue to get to that 3-4 million, a cyclical peak that drives year-over-year growth but sequential decline. That gets to the power of that special event. I remember being at HBO and we'd seen the same thing in our core programming back then but not in the degree we see it because WrestleMania is our Super Bowl.

Q: UFC is for sale. Is WWE interested in purchasing it? If it gets an elevated valuations what implications for WWE valuations?

Barrios: We don't talk about acquisitions. I'm not going to answer that question. As far of the valuation, not much - it just keeps amplying the value of content. It just another datapoint.

Martin points out UFC valuation is possibly 4B. Which is like three-times as large as you (WWE), even though you're forty years old.

Barrios: We don't talk about acquisitions. I'm not going to answer that question. As far of the valuation, not much - it just keeps amplying the value of content. It just another datapoint.

Martin points out UFC valuation is possibly 4B. Which is like three-times as large as you (WWE), even though you're forty years old.

Barrios: I'll give you a buck if you can find a subscription service that doesn't give it away for free.

Martin: Maybe they don't give their SuperBowl for free.

Barrios: There's no cost to you. Other than that opportunity cost for that subscriber. We said, "Why wouldn't we do it?"

Martin: Do you suspend 30-day free trial for period over WrestleMania? Then opportunity cost is only $10 for that period.

Martin: Maybe they don't give their SuperBowl for free.

Barrios: There's no cost to you. Other than that opportunity cost for that subscriber. We said, "Why wouldn't we do it?"

Martin: Do you suspend 30-day free trial for period over WrestleMania? Then opportunity cost is only $10 for that period.

Barrios is calling their churn "average 10% a month".

On the earning call, the day after WrestleMania, if things moved the way they've moved in the past, we thought we'd average 1.5 million +/- 2%. We expect it would be similar to what we've seen before.

Martin: 10% churn is about 10-months. They pay for 10 months and churn out.

Barrios: Not a lot of people report Churn. Netflix doesn't.

Barrios is now playing "how many different ways to calculate churn" (subscriber churn vs order

Barrios says different between sub & order churn as join 1/1,leave 1/15, rejoin 1/20 is a win-back and a loss. In the Cable business, if you're a sub in both periods, no churn.

Martin: Your 10% might equate to 7% in the Cable business.

Barrios says different between sub & order churn as join 1/1,leave 1/15, rejoin 1/20 is a win-back and a loss. In the Cable business, if you're a sub in both periods, no churn.

Martin: Your 10% might equate to 7% in the Cable business.

More coverage of WWE Q1 Results and WWE International Market Strategy at SeekingAlpha.

No comments:

Post a Comment